You just finished a 10-hour job. The client paid, you shook hands, and you drove away feeling productive. But when you look at your bank account at the end of the month, the numbers don’t add up. You’re working harder than ever, but your business isn’t growing. Sound familiar?

This is the "silent killer" of the field service industry. Whether you are running a landscaping crew, fixing HVAC units, or offering pressure washing services, the math you do before the job often matters more than the work you do during the job.

Many professionals in the home service industry are excellent at their trade but rely on "back-of-the-napkin" math to price their services. The result? You might be accidentally working for free without even knowing it. Today, we are changing that. We are thrilled to announce the release of our newest free resource: the Service Price & Profit Margin Calculator.

The "Markup" Trap: Why You Are Undercharging

Let’s be honest. How do you currently price a job? If you are like 80% of contractors, you probably estimate your costs (labor + materials) and then "tack on" 20% for profit.

This is called Markup, and it is dangerously misleading.

If a job costs you $100 to perform, and you add a 20% markup, you charge the client $120. You think you made a 20% profit. But you didn't. You made $20 off a total revenue of $120. That is actually only a 16.6% margin.

Over thousands of dollars and hundreds of jobs, that missing 3.4% bleeds your company dry. To actually keep 20% of the money you collect (which is called Gross Margin), the math is different. You need to charge $125, not $120.

Stop Doing Mental Math

Mental math ignores overhead, taxes, and true margin. Use tools designed for pros.

Introducing: The Service Price & Profit Margin Calculator

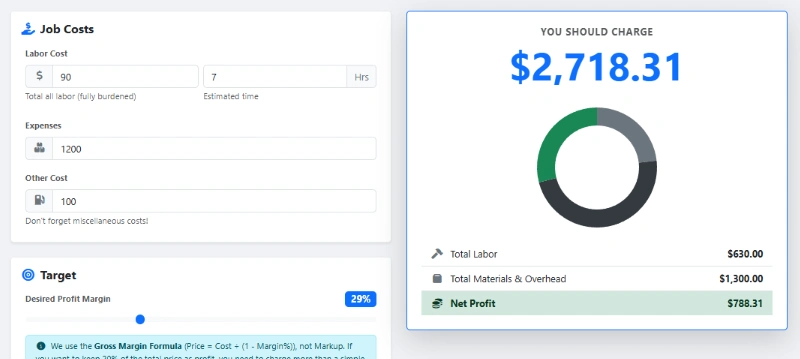

We built this tool specifically for service businesses. It uses the industry-standard Gross Margin Formula automatically, so you never undercharge again.

5 Critical Elements of a Profitable Price

Using our new calculator is simple, but it forces you to think about five key numbers that many new business owners overlook.

1. True Labor Cost

It’s not just the hourly wage you pay your employee (or yourself). Does your hourly rate account for the drive time to the site? The time spent loading the truck? If you pay a tech $25/hour, your actual cost after taxes and downtime is likely closer to $35/hour. Our tool asks for your Total Rate per hour to keep you honest.

2. Materials

This is the easiest part, yet often underestimated. If you are a painter, you count the paint. But do you count the tape, the drop cloths, and the brushes? Direct expenses must be tracked down to the penny.

3. The "Invisible" Overhead

This is where businesses die. Our calculator includes a field for Expenses / Misc. You must account for fuel, vehicle wear and tear, business insurance, and even your cell phone bill. If you don't charge the client for these, you are paying for them out of your own pocket.

4. Desired Profit Margin

This is your growth fuel. Profit isn't just "what's left over." It is a deliberate goal. Our tool allows you to set a target percentage (e.g., 20% or 30%). It then works backward to tell you exactly what the invoice total needs to be to guarantee that profit hits your bank.

5. The Final Price

The output of the calculator is your Sell Price. This is the number that ensures all costs are covered AND your profit goal is met. It removes the emotion from pricing. You don't have to "feel" if the price is right; the math proves it is.

Imagine you are bidding on a landscaping cleanup job.

- Labor: 2 workers for 4 hours at $20/hr = $160 cost.

- Materials: Mulch and disposal bags = $80 cost.

- Overhead: Fuel and equipment maintenance = $30 cost.

- Total Cost: $270.

The Old Way (Markup): You add 20% to $270. Your price is $324. Profit is $54.

Result: After unforeseen delays, you barely break even.

The WorkQuote Way (Margin): You use the Calculator. You input $270 cost and slide the bar to 20% Profit Margin. The tool tells you to charge $337.50.

That is an extra $13.50 in your pocket for the exact same work. Multiply that by 100 jobs a year, and you just gave yourself a $1,350 raise just by using better math.

You Have the Right Price. Now What?

Calculating the perfect price is step one. But texting a bare number like "$337.50" to a client looks unprofessional and often leads to rejection. Perception is reality in the service industry.

To win the bid at your new, profitable rate, you need to present it professionally. This is where the WorkQuote App ecosystem comes in.

Professional Estimates

Turn your calculated price into a branded PDF estimate in seconds using our Estimate Generator.

Job Scheduling

Once they accept the quote, schedule the crew and track the job status instantly.

Profit Reports

Track your actual vs. estimated costs over time to see which jobs are making you the most money.

The Service Price Calculator is a powerful standalone tool, but it works best when paired with a system that manages the entire lifecycle of your customer interaction.

Stop Leaving Money on the Table

You work too hard to guess at your prices. The difference between a struggling contractor and a thriving business owner is often just a few percentage points of margin.

Take control of your finances today. Bookmark our free calculator, run the numbers for your next bid, and see the difference confidence makes.

Frequently Asked Questions About Service Pricing

What is a good profit margin for service businesses?

While it varies by industry (e.g., plumbing vs. house sitting), a healthy net profit margin for home service businesses typically ranges between 10% and 20%. However, to achieve this net profit, your gross margin on estimates often needs to be 30% to 50% to cover overhead.

Should I charge hourly or flat rate?

Flat rate pricing is generally superior for profitability. It rewards efficiency and provides price certainty to the customer. Our calculator helps you convert your estimated hours into a profitable flat rate price.

How do I calculate overhead?

Add up all your fixed monthly costs (insurance, truck payments, marketing, software) and divide by the number of billable hours you work in a month. This gives you an "overhead per hour" figure that must be added to every job.