You hired a new tech for $25 an hour. You bill him out at $45 an hour. On paper, you’re making a $20 profit for every hour he works. So why is the company bank account essentially flatlining at the end of the month?

It’s the most common math error in the home service industry, and it kills more small businesses than bad reviews ever could.

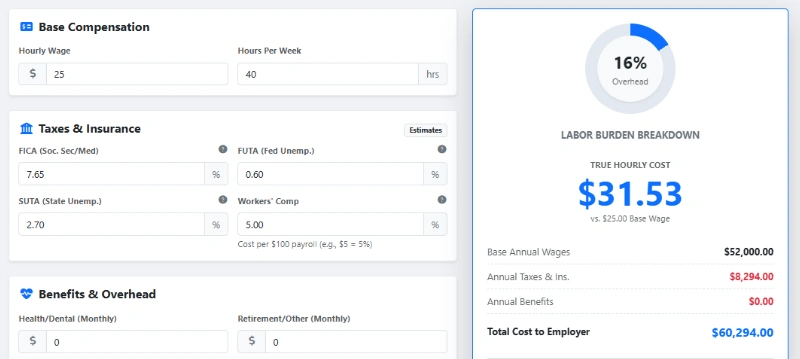

The problem isn’t your work ethic. The problem is that $25 an hour isn’t actually $25 an hour. Once you factor in the "silent killers"—payroll taxes, insurance, benefits, and unbillable downtime—that employee might be costing you $38, $42, or even $50 an hour. If you’re still billing them out at $45, you aren't running a business; you’re running a charity.

Stop Guessing. Start Calculating.

We built a free tool to handle the complex math for you. Find out exactly what your employees cost you down to the penny.

Open Labor Burden CalculatorWhat is "Labor Burden" (and Why Should You Care)?

In the corporate world, they call it "Labor Burden." In the field service world—whether you're in landscaping, HVAC, or plumbing—we just call it "Overhead."

Labor burden is the sum of all the indirect costs associated with having an employee. These are costs you pay just for the privilege of having them on your payroll, before they even pick up a wrench or a paintbrush.

- FICA Taxes: Social Security and Medicare matching.

- FUTA & SUTA: Federal and State unemployment taxes.

- Workers' Comp: Mandatory insurance that rises with risk.

- Liability Insurance: General coverage for your crew.

- Benefits: Health insurance, 401(k) matching, PTO.

- Perks: Uniforms, phones, and vehicle allowances.

According to the Small Business Administration (SBA), these costs typically add 1.25 to 1.4 times the base salary to your expenses. That means your $25/hour technician actually costs you between $31.25 and $35.00 before you even add profit margin.

The "Unbillable" Trap

Here is where many estimating apps fall short. They assume an 8-hour day means 8 hours of billable work.

Your crew spends time driving to job sites, loading trucks, sitting in traffic, cleaning up, and attending safety meetings. If you pay a tech for 40 hours a week, but they only do billable work for 30 hours, your True Hourly Cost skyrockets.

If you don't account for this "efficiency rate" in your job estimates, you are paying your customers to let you work on their houses.

5 Steps to Find Your True Number

We designed the Labor Burden Calculator to be simple enough for a busy contractor but powerful enough for an accountant. Here is how to use it to save your margins:

Enter Base Wages

Input the hourly rate you offer in the job interview.

Input Tax Rates

Enter your FICA (usually 7.65%), FUTA, and SUTA rates. If you don’t know them, check your last payroll run or ask your accountant.

Add Insurance & Benefits

Add up monthly health premiums, workers' comp rates (per $100 of payroll), and any retirement matching.

Estimate Billable Hours

Be honest. If they work 2,080 hours a year (40hrs x 52 weeks), how many of those hours are actually spent on a paying job? Deduct holidays, vacation, and average drive time.

See the Truth

The calculator will spit out your True Hourly Cost. This is your "Break Even" point.

Now What? How to Use This Data in WorkQuote

Once you know your True Hourly Cost (let's say it's $38.50), you can finally build estimates that guarantee profit.

When you open the WorkQuote app to build a new proposal, you shouldn't just guess a price.

- Take your True Hourly Cost ($38.50).

- Add your desired Profit Margin (e.g., 20%).

- Add your Overhead Markup (office rent, software, marketing).

Now, when you use our invoicing features, you can be confident that every invoice sent isn't just covering wages—it's building the future of your company.

The Bottom Line

Knowledge is profit. You can't fix what you don't track.

Stop guessing. Use the free Labor Burden Calculator today to find your baseline. Then, use WorkQuote to turn those numbers into professional estimates that win jobs and actually make money.